Privacy statement: Your privacy is very important to Us. Our company promises not to disclose your personal information to any external company with out your explicit permission.

ES EUROPE TREND PAPER: FIVE COUNTRIES ARE DRIVING GROWTH IN THE EUROPEAN STORAGE SYSTEM MARKET.

Munich/Pforzheim, March 2022: You do not have to be able to see into the future to predict that electricity prices for private households will continue to be on the rise in the next few years – and throughout Europe too. At the same time, production costs for solar power have been falling, both for power directly from roof-mounted systems and from residential storage systems.

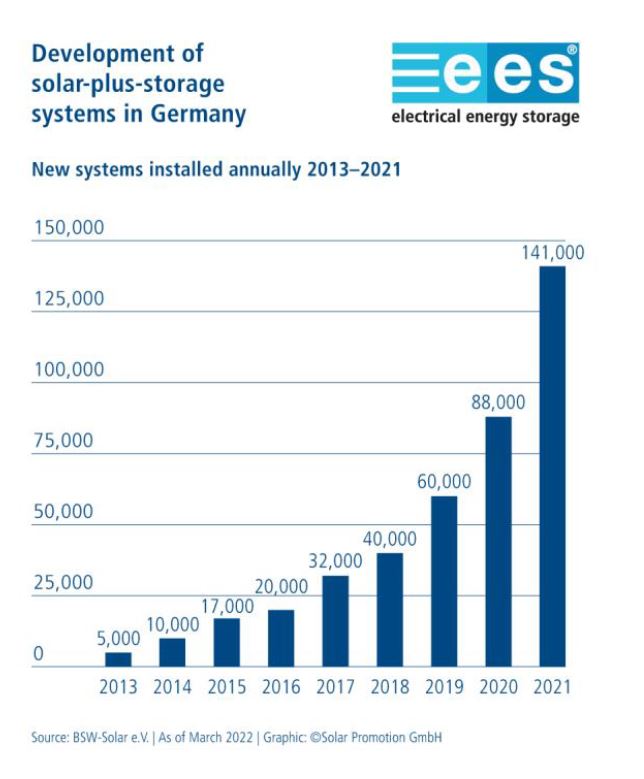

According to a recent study by the industry association SolarPower Europe, the best solar and storage installations in Germany currently reach electricity generation costs of as little as 12.2 eurocents per kilowatt hour (kWh). Consequently, solar power is becoming increasingly attractive on the European market and beyond. Conversely, electricity from the grid costs private households in Germany around three times as much. The German Solar Association (BSW Solar) reports that more than 140,000 new battery systems were installed in Germany in combination with photovoltaic systems last year alone. Further market growth is also expected this year – one reason being the Ukraine war.

Given these framework conditions, it comes as no surprise that the number and storage capacity of newly installed systems has risen sharply in the last five years. Figures from EUPD Research and the German Solar Association demonstrate this. According to them, even under difficult circumstances due to the COVID-19 pandemic, around 73,000 battery systems were installed in private homes in Germany in the first half of 2021. That`s 59 percent more than in the same period of the previous year. The growing installed capacity of photovoltaic systems is considered one important driving factor behind this trend. Systems ranging from 10 to 15 kilowatt (kW) as well as from 15 to 20 kW in particular have seen a steep growth since the EEG amendment in early 2021, with the number of installed storage systems growing in parallel.

In Germany, four manufacturers have been dominating the storage market: Together, the brands sonnen, BYD, E3/DC and senec cover three-quarters of this market. All other suppliers of storage systems currently only reach market shares of less than ten percent.

The European residential storage system market is growing

But how does Germany`s rapid market growth compare to the European average? SolarPower Europe`s European Market Outlook for Residential Battery Storage 2021–2025, which was published in November 2021, provides answers to this question. According to the study, newly installed capacity from electricity storage systems in private households rose by 44 percent in 2020 compared to the previous year. Despite challenging market conditions due to the COVID-19 crisis, approx. 140,000 systems installed saw the European storage market exceed 100,000 installed battery units for the first time in 2020. This amounts to 413,000 installed residential storage systems in total for the German market. Simultaneously, 1,072 megawatt hours (MWh) of newly installed storage capacity within a single year meant that the market broke the important gigawatt hour threshold for the first time. According to the association, a further increase in demand for private photovoltaic systems and residential storage systems is expected this year, in part due to the Ukraine war and the associated energy crisis. Consumers see this as a chance to protect themselves against rising energy costs and supply shortages in the long term.

While these figures already reflect a successful year for manufacturers of storage systems, the cumulative growth of installed storage capacity is even more striking. In 2019, storage capacity for private households grew from less than 2 gigawatt hours (GWh) to over 3 GWh by 2020, which equals an increase of 54 percent over the previous year. The total storage capacity has risen tenfold since 2015.

The top 5 residential storage system markets in Europe

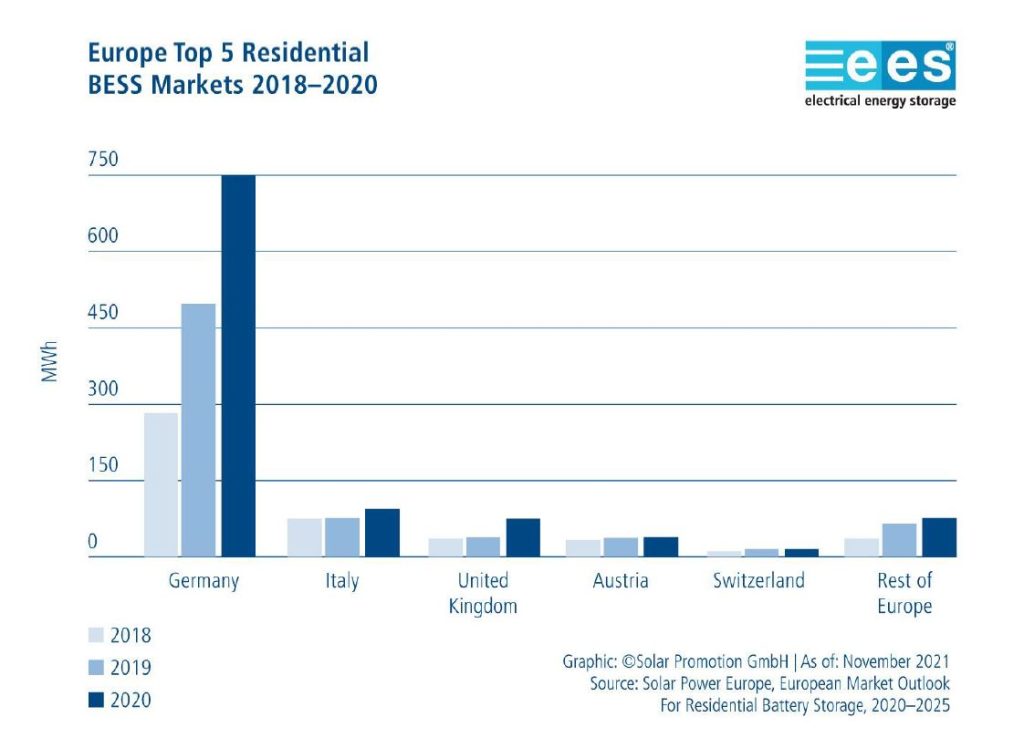

In a country-by-country comparison, Germany is still the European leader for both photovoltaics and residential battery storage systems. Installation figures for 2020 indicate that the German market accounts for around 70 percent of the total installed capacity in the European residential storage system market, making it a force that cannot be overlooked. According to these figures, newly installed storage capacity in Germany grew by 51 percent to 749 MWh in 2020 compared to the previous year. Lagging behind Germany by a considerable margin, the other four countries making up the top 5 of the European residential storage system market are Italy, Great Britain, Austria and Switzerland. Together, these five countries are home to 93 percent of all European residential storage systems.

According to SolarPower Europe, the introduction of the Superbonus 110 percent scheme in Italy (a tax credit covering 110 percent of the cost for the low energy renovation of residential buildings, including the installation of solar and storage systems) as well as already existing incentive programs led to a 44 percent market growth (94 MWh) in 2020.

In Great Britain, market growth for 2020 amounted to 25 percent compared with the previous year, i.e. around 11,000 newly installed storage systems (81 MWh). In this context, the sharp reduction and ultimately suspension of the feed-in tariff for solar power in the residential sector continues have an effect, with the United Kingdom recording comparatively few residential photovoltaic installations, and a more pronounced growth of the storage market being thwarted.

In Austria, market growth amounted to around 10 percent in 2020 compared to the previous year, with 6,000 storage systems (41 MWh) newly installed. Switzerland also experienced rapid developments, with an increase in the storage system market of 39 percent (18 MWh) in 2020. Both countries established governmental incentive programs and created favorable political framework conditions.

Further price reduction and more installations

For the next few years, analysts predict that prices are going to keep falling. By 2030, the price for lithium-ion batteries is expected to reach more than half of what it is today. Conversely, currently rising prices for photovoltaic installations and residential battery storage systems are considered a temporary trend. With supply chains being adjusted, SolarPower Europe expects the situation to calm down again by the second half of 2022, with market growth picking up again. It remains to be seen to what extent the Ukraine war will have an impact on the recovery of supply chains.

Accordingly, 2022 promises to be an exciting year for suppliers and manufacturers of battery storage systems, as well as for installers and users of photovoltaic and electricity storage systems.

Industry meeting point: ees Europe 2022 and related specialist conferences

ees Europe, which will take place from May 11–13, 2022, at Messe München as part of The smarter E Europe, provides an overview of trends and technology, markets and market participants. As Europe`s largest and most international exhibition for batteries and energy storage systems, ees Europe 2022 and the accompanying ees Europe Conference will also focus on the exciting area of the storage system market for private homes, commercial and industrial enterprises. The ees Europe Conference takes place from May 10–11 at ICM – Internationales Congress Center München, one day before the start of the exhibition.

Exhibitors ees Europe 2022

ees Europe Conference 2022:

Mr. Jerry Wang

Tel:

+86-514-82106897

Fax:

+86-514-82106898

E-mail:

Related Products List

Mobile Site

Privacy statement: Your privacy is very important to Us. Our company promises not to disclose your personal information to any external company with out your explicit permission.

Fill in more information so that we can get in touch with you faster

Privacy statement: Your privacy is very important to Us. Our company promises not to disclose your personal information to any external company with out your explicit permission.